Do You See Stocks Rebounding This Summer?

Equities have had a long and grinding bear market since the start of the year, with the SP500 giving up 14.6% to date.

As most selloffs, there are multiple plausible catalysts for this – the inflation surge and subsequent hawkish reaction by the Fed, lingering effects of Covid on supply chains, recession risks, etc.

Some investors may be seeking to identify whether (and when) are these headwinds receding, allowing a price recovery for in stocks. Historically, this is like trying to catch a falling knife – the risk often outweighs the potential benefits.

Capturing Upside

While Limiting Losses

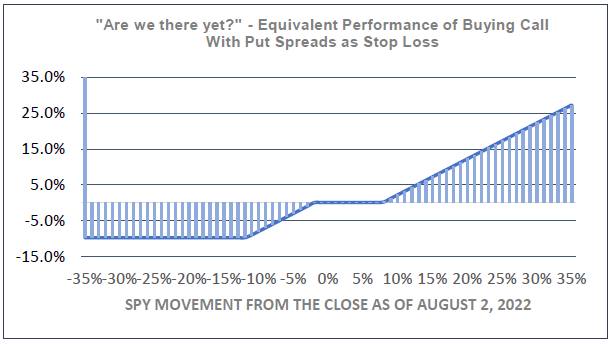

This strategy replicates the performance of buying 100 shares of the SPY (app. $41,000) with a hard stop-loss at 11.8% capturing 100% of the upside above 7.8%.

A call option that is 7.8% out of the money on the back end (Sep 30) fully financed by selling put spreads in the front-end (Aug 5 to Aug 26) allows to capture the bulk of the upside of a rebound with a hard cap in potential losses if the selloff continues (i.e., stop loss).

What could go wrong with this type of strategy?

The strategy is eminently directional – its benefits are aligned with a recovery in equity market prices. If the market continues to sell down, the investor risks losing 100% of the collateral posted. If the investor posts $4,000 collateral – which is proportional to a $41,000 exposure in the underlying SPY – and the SPY drops by more than 12.1% by the end of August, the investor could book a loss of up to the entire $4,000.

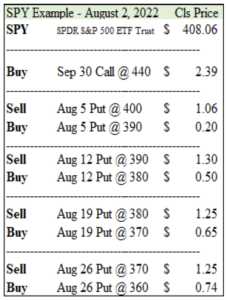

Strategy Example:

The strategy includes buying a Sep 30 call option on the SPY striking at $440. This option allows the investor to capture 100% of the gains equivalent to buying ~$41,000 in SPY shares if the SPY rises more than 7.8%.

To offset the cost of purchasing the call option, the strategy includes put spreads in the front end, as follows:

• Selling a 400 and buying a 390 put contract expiring Aug 5 (3 days)

• Selling a 392 and buying a 382 put contract expiring Aug 12 (10 days)

• Selling a 382 and buying a 372 put contract expiring Aug 19 (17 days)

• Selling a 372 and buying a 362 put contract expiring Aug 26 (24 days)

These put spreads require posting cash collateral as they could produce a $1,000 loss each. However, that loss would only happen if the market drops below the bottom of the spread by the expiration date. Thus, the $4,000 loss would only happen if the market falls 4.4% by Friday August, 6.9% by August 12, 9.3% by August 19, and 11.8% by August 26. If that selloff doesn’t happen, the investor’s collateral is released.

The put spreads finance the purchase of the call option (the net balance will depend on execution). Using a single call contract, the equivalent position is similar to buying 100 SPY shares (approximately $41,000 market value), surrendering the first 7.8% of upside, limiting the loss to 10% of the underlying value if the stock market drops 12.1% in the first month, and break even if the market moves between a 2.0% loss and a 7.8% gain.

Thesis and Timing:

With the August recess coming, the Federal Open Market Committee (FOMC) will not take any rate action until September 20-21. In the September meeting, the FOMC will also produce its 3rd quarter Summary of Economic Projections.

The market has internalized relatively bearish expectations, including the continuation of rate increases into 2023 and a material softening in GDP expansion with high likelihood of a recession in Europe and, to a lesser extent, the United States.

However, some investors are looking for early signals of an amelioration in these negative catalysts, such as:

- The continuing strength in the US$ that drives commodity prices lower and is generally disinflationary in the US,

- A price drop in certain commodities and manufactured products that could reduce the Fed’s urgency to tighten policy

- The continued resilience of the employment market in the US that reduces the likelihood of a deep recession.

Information on Disclosure Agreements

© 2022 Securities are offered by Lime Trading Corp., memberFINRA & SIPC,NFA, Lime Advisory Corp is aninvestment adviser registered with the SEC. and Lime FinTech is a technology business. Collectively known as“Lime Financial” or “Lime” provide various trading, investment advisory services, and technology solutionsincluding web and mobile trading applications, to retail and institutional investors. All investing incurs risk,including but not limited to loss of principal. Further information may be found on our Disclosures Page.

Please read the Options Disclosure Document titled “Characteristics and Risks of Standardized Options”before trading options.

Options trading entails significant risk and is not appropriate for all investors. Certain options strategiescarry additional risk and investors may lose 100% of funds invested in a short period of time. Investors shouldconsult with a tax advisor as to how taxes may affect the outcome of any options strategy. Options tradingprivileges are subject to Lime Trading Corp. review and approval. Transaction costs may be significant inmulti-leg option strategies, including spreads and straddles, as they involve multiple commission charges.

This material has been prepared for informational purposes only and is NOT intended to provide nor should itbe relied on for tax, legal, or accounting advice. Please consult your own tax, legal, and accounting advisorsbefore engaging in any securities transactions as each individual investment(s) may result in diverse/adversetax implications that will affect the outcome of any investment strategy. No information presented hereinshould be considered an offer to buy or sell a particular type of security. This is not an offer or solicitation inany jurisdiction where we are not advertised to do business. Other fees, such as regulatory, service, or otherfees, may apply. Please visit our Pricing Page for further information. Investments involve risk, pastperformance does not represent future results. Diversification may help spread risk but does not protect in adown market. You may lose all of your investment. Investors should evaluate their financial situation,investment objectives, and goals before investing. Substantial risks are involved with electronic trading. Daytrading involves significant risk and is not suitable for all investors. Please see our Day Trading RiskDisclosure Statement for more detailed information. Trading on margin is not appropriate for every investor.Please see our Margin Disclosure Statement for information on risks. System response may vary due tomultiple factors including but not limited to trading volumes, market conditions, system performance, andother factors. Access to electronic services may be limited or unavailable during periods of peak demand,market volatility, systems upgrades, maintenance, or for other reasons.