Missed Chances Don’t Need to Hurt So Bad Every investor, big and small, has had the sinking feeling of doing the homework on a stock, liking it, and deciding to buy, only to see it rally before placing the order. Conventionally, the strategy is to maintain entry-price...

All Lime Newsletters

What’s the deal with growth mega-caps?!

Netflix & Tesla Growth stocks are tricky. They provide head-spinning rallies on the up, and stomach-churning drops on the down. Investors can be miffed by this conundrum – why have we seen a 53% (NFLX) and 40% (TSLA) trailing-24 month drop in prices when the...

Lifting the Markets in the New Year

Investing in your New Year’s Resolution The New Year is around the corner and resolution season is about to hit. Those of us that still carry quarantine weight may promise ourselves to watch less TikTok’s and lay off the junk food, and instead to read new books and...

Gamblers Gamble

Football, Fútbol, Soccer? Who cares, gamblers gamble! Gambling as an industry – particularly sports betting and iGaming – is growing fast. What was once relegated to March Madness office pools and friendly Super Bowl bets, is now a multi-billion-dollar industry,...

Inflation Schmination

Confused by Inflation? Inflation matters. Every so often the market removes inflation from its radar screen, only for it to violently claim back its place atop the totem pole of market worries. Investors tend to be well acquainted with the benefits of diversification...

Know Unknown

Event-Specific Inflection Points – More Frequent Than One Thinks Events happen. As a result, some of the most impactful occasions are scheduled – elections, black Friday, Fed meetings – so we know when to expect them. But...

Is the Market Spooky?

Is the Market Scared? One of the market’s main headscratchers: how can the same piece of news trigger opposite reactions? How can an announcement in employment numbers be interpreted as a positive sign of consumer strength, or, most likely, a negative sign of Fed...

Repricing Insurance

Buying Insurance in the Equity Market Investing in equities is inherently risky, but the capital market offers alternatives to mitigate this downside. Diversification is well understood by most investors, but it’s a limited tool. Mixing bonds and stock, or maintaining...

The Amazing American Consumer

In a Brittle Economy, the American Consumer Remains King In this series of Newsletters, we have covered different investment strategies using a spectrum of instruments, for example, directional as well as hedging strategies with options, currency tilts with ETFs and...

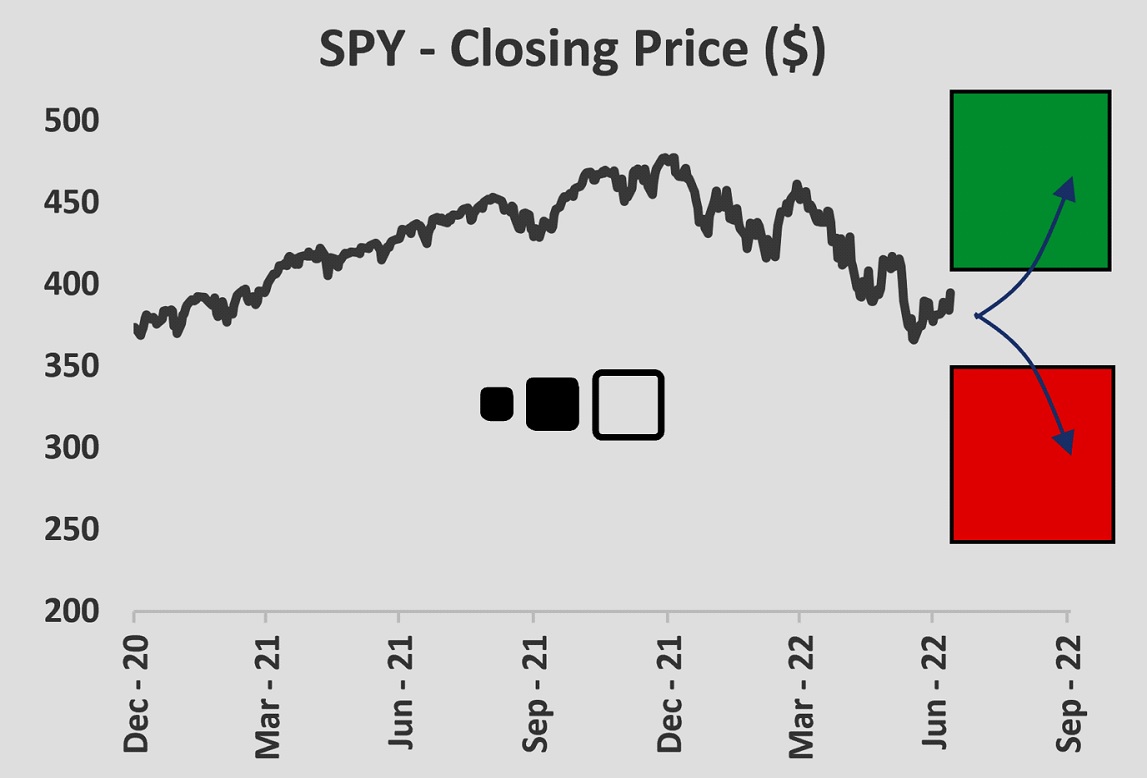

Sink or Swim Reloaded

What If We Expect a Robust Rally or Deep Sell-Off? At the start of the summer in Issue 1, Make or Break Summer for Stocks (July 20), we presented a “bifurcated outlook” strategy, which is based on investors’ expectations of either a strong rebound, (swim), or...