The Dollar is Ripping, And Foreign Firms Take Advantage

International trade is highly sensitive to currency rates. Foreign manufacturers and American firms share a highly competitive global marketplace.

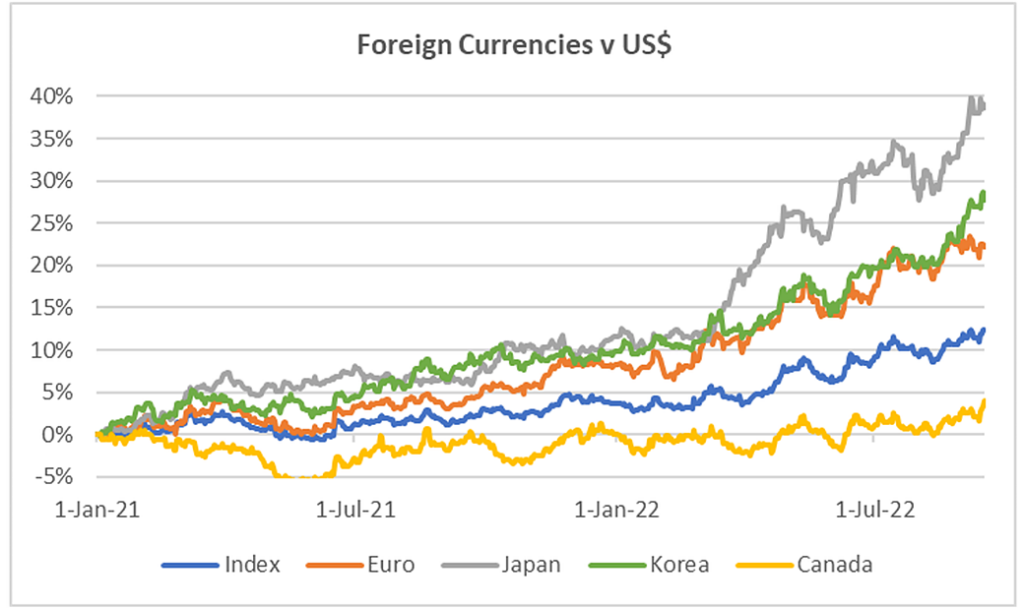

This is evident now; the dollar is 12.4% stronger against a trade-weighted basket of currencies, and 20% to 40% stronger against some of the country’s largest trading partners (Korea, Jana, and the Eurozone). This implies, for example, that an American tourist with $100 in Tokyo can buy 40% more stuff – or an electronics manufacturer in Korea can build gadgets 30% cheaper than an American competitor.

The strong dollar trend started in early 2022, when the Fed started raising rates. With treasuries yielding circa 4% (vs 1.5% at the end of 2021), investors that previously looked for yield in riskier markets bring their capital to the US. Moreover, few – if any – market analysts expect any inflection given the widening trade deficits in energy-dependent Japan, Korea, and the Eurozone.

Where to Look for Opportunities- Domestic Importers, ADRs, and ETFs

Investors have traditionally looked at domestic importers as a play on a strong dollar. Retailers Walmart, Target, and Home Depot are the three largest individual importers of goods by volume (container units), and the strong US$ cuts the price they pay when buying inventory

However, the markets offer two simple ways for American investors to invest in foreign markets and companies – Country ETFs, and American Depositary Receipts (ADRs).

Country ETFs offer exposure to the wider equity market in foreign countries. ETFs of high-grade markets with a heavy presence of exporters gaining from a strong US$ include: EWG (Germany), EWJ (Japan), EBY (Korea).

However, ADRs offer direct exposure to companies gaining from the strong US$. ADRs are “mirror securities” registered, regulated, and listed in the US, but that replicate the performance of foreign listed stocks. For example, TM – Toyota Motors ADR listed in the NYSE – “transfers” the performance of the stock traded in Tokyo to its ADR listing.

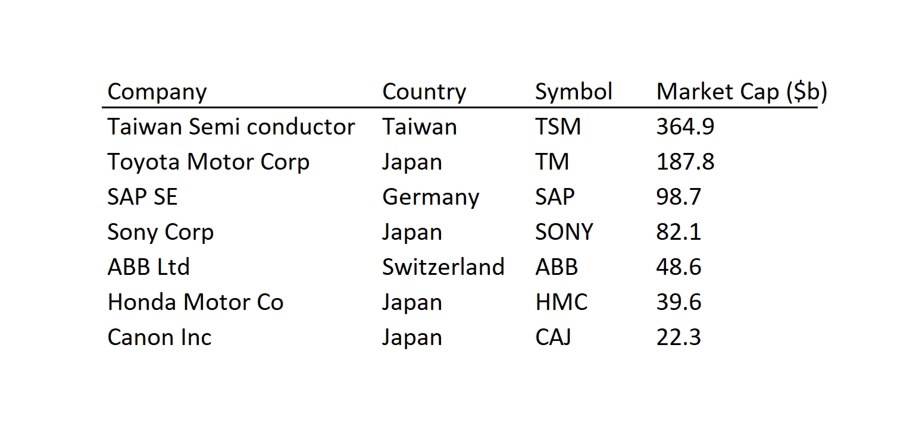

Some liquid, high-grade ADRs of foreign capital goods manufacturer listed in the NYSE are:

What could go wrong with this type of strategy?

ADRs are indirect investments in foreign markets. These markets carry risks that may be unfamiliar to American-based investors, from political environments to economic policies and regulation. Developed markets tend to have a more stable backdrop compared to emerging markets, but they still include risks including currency and sovereign, credit rating, liquidity and volatility, corporate governance, etc. Investors without foreign markets’ experience should consider educating themselves in their target market prior to execute investing.

Information on Disclosure Agreements

© 2022 Securities are offered by Lime Trading Corp., member FINRA & SIPC, NFA, Lime Advisory Corp is an investment adviser registered with the SEC. and Lime FinTech is a technology business. Collectively known as “Lime Financial” or “Lime” provide various trading, investment advisory services, and technology solutions including web and mobile trading applications, to retail and institutional investors. All investing incurs risk, including but not limited to loss of principal. Further information may be found on our Disclosures Page.

Please read the Options Disclosure Document titled “Characteristics and Risks of Standardized Options” before trading options.

Options trading entails significant risk and is not appropriate for all investors. Certain options strategies carry additional risk and investors may lose 100% of funds invested in a short period of time. Investors should consult with a tax advisor as to how taxes may affect the outcome of any options strategy. Options trading privileges are subject to Lime Trading Corp. review and approval. Transaction costs may be significant in multi-leg option strategies, including spreads and straddles, as they involve multiple commission charges.

This material has been prepared for informational purposes only and is NOT intended to provide nor should it be relied on for tax, legal, or accounting advice. Please consult your own tax, legal, and accounting advisors before engaging in any securities transactions as each individual investment(s) may result in diverse/adverse tax implications that will affect the outcome of any investment strategy. No information presented herein should be considered an offer to buy or sell a particular type of security. This is not an offer or solicitation in any jurisdiction where we are not advertised to do business. Other fees, such as regulatory, service, or other fees, may apply. Please visit our Pricing Page for further information. Investments involve risk, past performance does not represent future results. Diversification may help spread risk but does not protect in a down market. You may lose all of your investment. Investors should evaluate their financial situation, investment objectives, and goals before investing. Substantial risks are involved with electronic trading. Day trading involves significant risk and is not suitable for all investors. Please see our Day Trading Risk Disclosure Statement for more detailed information. Trading on margin is not appropriate for every investor. Please see our Margin Disclosure Statement for information on risks. System response may vary due to multiple factors including but not limited to trading volumes, market conditions, system performance, and other factors. Access to electronic services may be limited or unavailable during periods of peak demand, market volatility, systems upgrades, maintenance, or for other reasons.

Exchange Traded Funds (ETFs) are subject to market risk, including the loss of principal. The value of any ETF and thus the portfolio that holds an ETF will fluctuate with the value of the underlying securities in the ETF reference basket. ETFs trade with the same brokerage commissions associated with buying and selling equities unless trading occurs in a fee-based account. ETFs often trade for less than their net asset value. Refer to HYPERLINK “https://scorepriority.com/disclosure-statements/”Exchange Traded Products Risk Disclosure for this and other important information.