High Quality at a Rare Discount

One of the few silver-linings of a market correction is finding the rare occasion for investors to pick stocks of high-grade, well run industry leaders at a valuation discount.

Investors with a positive view of the market and appetite for high-quality stocks have multiple strategies available to them, two of which are:

Choose long-term high-grade portfolio directly owning the stocks

Conventional strategy of embracing the sell-off to build a long-term (3yr+) portfolio starting at an attractive entry point.

Implement a short-term strategy to optimize a market rebound by year-end

Organize 5mos call options financed by sub-1mos put spreads

Both these strategies can be executed as a portfolio – thus accruing the benefits of diversification – or through individual names if investors had a specific exposure appetite.

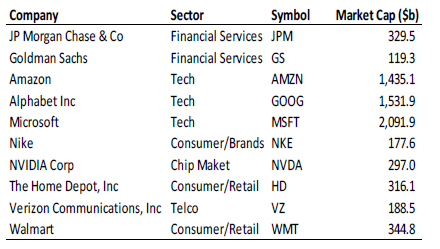

Opportunistically Picking Industry Leaders

In a market in which mega-cap, high-grade stocks are some of the heaviest weights in index-tracking funds, these names are typically some of the most affected when investors redeem their capital from the equity market.

This is a list of high-grade companies typically considered as consolidated leaders in their industry, with a proven track record whose fundamental businesses have not been materially affected by Covid, inflation, or the increase in interest rates, but whom nonetheless are trading at material discounts to their historical valuations

What could go wrong with this type of strategy?

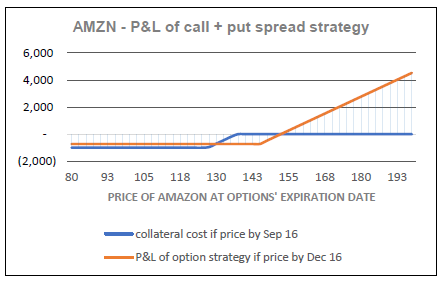

Both the short-term options-based strategy and the long-term equity portfolio strategy are directional – i.e., their benefits accrue only if the market recovers. However, their downside is very different – the options-based strategy risks losing 100% of the capital invested, whereas the long-term strategy has the conventional risks of investing in the equity market (volatility, poor performance, exposure to macro trends, etc.). If the investor posts $1,000 of collateral in the options strategy and the underlying portfolio drops over 10%, the investor could lose the entire $1,000. (Results will be subject to final execution prices).

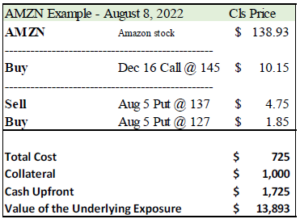

Short-term strategy Example – Amazon:

Using Amazon as the underlying example (i.e., to reiterate, this strategy can be executed by single names, such as this example, or a portfolio of highquality stocks trading at discounted valuations), the strategy to mimic the upside of approximate $14,000 if the market were to rebound would include:

•Buying a December 16, 2022, call option with a $142 strike, at a cost of $1,015 per contract.

•Selling a September 9, 2022, put option with a $137 strike and buying a put option with the same expiration and a $127 strike. This combination –

the put spread – would provide $290 in cash to the investor and would require posting $1,000 against potential losses over the next 30 days.

The call option allows the investor to receive 100% of the upside of $13,893 worth of Amazon stock above a 4.4% gain by December 16, 2022. The flip side is that if the stock were to drop more than 1.4% over the next 30 days, the investor would partially or completely lose the posted collateral (losses start at a 1.4% drop and

max out at $1,000 with a 8.6% decline in AMZN). If neither a 1.4% drop by mid-September or a 4.4% gain by mid-December were to happen, the investor would only lose the $725 in net cost for the options’ premia.

Thesis and Timing:

This option strategy is directional over the next 4 months – i.e., it requires the underlying stock or portfolio, in this example AMZN, to increase in value more than 4.4% by December 16, 2022.

These 10 stocks have a strong correlation with the market. These names represent some of the greatest components in the indices followed by the largest index-tracking exchange traded funds (ETFs) such as the SPY (S&P500) and QQQ (Nasdaq). Thus, when investors subscribe to these ETFs the capital moves in greater proportion to these large cap stocks.

Information on Disclosure Agreements

© 2022 Securities are offered by Lime Trading Corp., memberFINRA & SIPC,NFA, Lime Advisory Corp is aninvestment adviser registered with the SEC. and Lime FinTech is a technology business. Collectively known as“Lime Financial” or “Lime” provide various trading, investment advisory services, and technology solutionsincluding web and mobile trading applications, to retail and institutional investors. All investing incurs risk,including but not limited to loss of principal. Further information may be found on our Disclosures Page.

Please read the Options Disclosure Document titled “Characteristics and Risks of Standardized Options”before trading options.

Options trading entails significant risk and is not appropriate for all investors. Certain options strategiescarry additional risk and investors may lose 100% of funds invested in a short period of time. Investors shouldconsult with a tax advisor as to how taxes may affect the outcome of any options strategy. Options tradingprivileges are subject to Lime Trading Corp. review and approval. Transaction costs may be significant inmulti-leg option strategies, including spreads and straddles, as they involve multiple commission charges.

This material has been prepared for informational purposes only and is NOT intended to provide nor should itbe relied on for tax, legal, or accounting advice. Please consult your own tax, legal, and accounting advisorsbefore engaging in any securities transactions as each individual investment(s) may result in diverse/adversetax implications that will affect the outcome of any investment strategy. No information presented hereinshould be considered an offer to buy or sell a particular type of security. This is not an offer or solicitation inany jurisdiction where we are not advertised to do business. Other fees, such as regulatory, service, or otherfees, may apply. Please visit our Pricing Page for further information. Investments involve risk, pastperformance does not represent future results. Diversification may help spread risk but does not protect in adown market. You may lose all of your investment. Investors should evaluate their financial situation,investment objectives, and goals before investing. Substantial risks are involved with electronic trading. Daytrading involves significant risk and is not suitable for all investors. Please see our Day Trading RiskDisclosure Statement for more detailed information. Trading on margin is not appropriate for every investor.Please see our Margin Disclosure Statement for information on risks. System response may vary due tomultiple factors including but not limited to trading volumes, market conditions, system performance, andother factors. Access to electronic services may be limited or unavailable during periods of peak demand,market volatility, systems upgrades, maintenance, or for other reasons.